Mindful Capital Partners supports the creation of a new Italian leader in the HVAC Sector through the acquisition of Lovato S.p.A. by Fiorini Industries S.r.l.

Milan, December 19th, 2024 – Fiorini Industries S.r.l. acquires 100% of Lovato S.p.A., consolidating its leadership in the Italian HVAC market.

A little over a year since the acquisition of Mindful Capital Partners, Fiorini Industries S.r.l. (“Fiorini”), a leading Italian company in the HVAC sector, announces the acquisition of 100% of Lovato S.p.A. (“Lovato”), a historic player in the industry with over 50 years of experience, located near Verona.

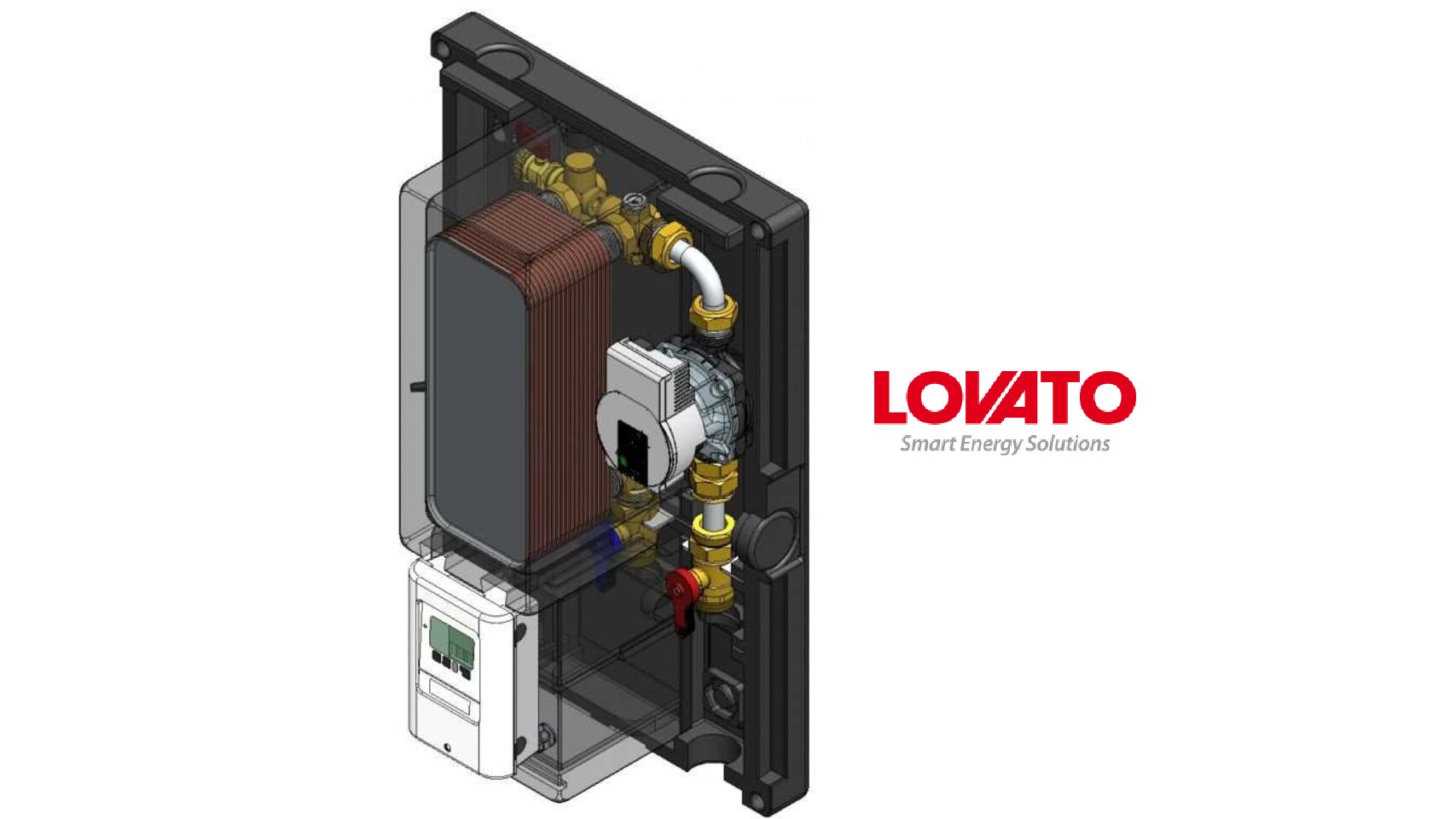

Lovato, founded in 1972 by Luigino Lovato and headquartered in Gazzolo d’Arcole (Verona), specializes in the development, production, and commercialization of components and solutions for residential heating, including distribution modules, hot water sanitary stations, hybrid heat pump cabinets, distribution manifolds, and storage tanks. The customer base is diversified, including major OEMs and a network of distributors, with exports accounting for 30% of revenue.

The four siblings – Michele, Daniela, Laura, and Davide – who represent the second generation of the Lovato family, believe in the industrial synergy project, reinvesting in the Group and remaining actively involved in its growth journey. Michele Lovato, as CEO, will be supported by his siblings Davide (Managing Director) and Daniela (accountable for purchasing and quality).

Fiorini is an Italian group with over 40 years of experience in the HVAC sector. The Group stands out for the development and production of components for hydronic systems, such as heat pumps, providing mid-to-high-end solutions for commercial, residential, and industrial applications. Its product portfolio is broad and diversified, thanks to numerous acquisitions made over the past 15 years, and includes tanks, hydronic kits, and heat exchangers.

Lovato’s business is highly complementary to Fiorini’s in terms of main product categories (tanks/distribution manifolds), applications (cooling/heating), end-users (commercial/residential), and also in terms of OEM customers served and distribution networks. This complementarity will enable the Group to develop cross-selling opportunities and significant synergies.

Thanks to the aggregation with Lovato, the Group will achieve a total turnover of approximately 60 million euros, further strengthening its prominent position in the sector.

The European regulatory framework, with ambitious decarbonization goals, is highly favourable in the medium to long term for Fiorini and Lovato’s solutions, which are positioned as ideal choices to support the energy transition.

Alberto Camaggi, Managing Partner of Mindful Capital Partners, states: “We are extremely proud to have completed the acquisition of Lovato, an excellence in the sector, with a strong and recognized brand in some of the most interesting product categories and a strong complementarity with Fiorini. This is a significant step forward in a project that, operating in close support of the energy transition in the HVAC sector, highlights the strong ESG connotation of our investment strategy”.

2

Antonio and Tommaso Fabbri, respectively Chairman of the Board and CEO of Fiorini, state: “With Lovato joining the Group, we achieve the goal of Italian market leadership and we further boost our international expansion, with the ambition to establish ourselves as leaders at European level as well.”

Michele and Davide Lovato, respectively CEO and Managing Director of Lovato, add: “We are proud to enthusiastically embark on this new partnership and equally confident that the integration between the two companies will strengthen market positioning both in terms of product offerings and growth prospects.”

***

MCP was assisted by LS Laghi & Partners for legal aspects of the transaction, Deloitte Financial Advisory for financial due diligence, STS Deloitte for tax due diligence and Tauw for ESG and EHS due diligence.

The transaction was financed by Banco BPM, assisted by Simmons & Simmons.

Notarial aspects of the transaction were handled by Studio Notarile Ciro De Vivo.

The Lovato family was assisted in the sale process by Francesco Silva of CUBE Advisory and by Colombo & Associati, with a team coordinated by Nicola Zambianchi, as financial advisors, by LCA Studio Legale for legal support and by Alberto Bellieni for the Lovato family interests.